In a world dedicated to having both a safe, clean, environment – represented in the COP21 Paris Agreement; and having economic progress – evident with the desire and drive for growth and prosperity, a consolidative and deployable approach that holds both these qualities with integrity, is needed. “There is no silver bullet to a 2-degree-or-less future. We need to stop putting carbon dioxide (CO2) into the atmosphere, and for that we need to fire off at least three bullets at once: energy efficiency, renewables, and carbon capture and storage (CCS),” as citied in the DNV-GL article by Kaare Helle and Anne Louise Koefoed.

Shifting away from the world’s dependence on fossil fuels for secure and reliable energy has been a slow process. In fact 81% of the world’s energy supply is still sourced from fossil fuels (Total Energy Supply by Type, IEA). This has been the situation for over 30 years. As long as it is in the mix, CCS is needed to close the emissions gap. Experts from governments and industry continue to stress that carbon capture is nothing new – in fact it is well understood and operating, so the barrier to mobilization is not the technical know-how, but rather due to a lack of policy or policy uncertainty.

In a climate of ambitious emission reduction targets, CCS has been proven to be a reliable and adaptive technology which will realize significant cost reductions – in a study spearheaded by the International CCS Knowledge Centre, next generation CCS plants could see capture capital cost reductions of 67% per tonne of CO2, bringing the cost of capture down to USD$45/tonne.

Business Models for CCS

- Emissions Being Cleaned Up – CO2 Capture (Models A,B,C), and

- CO2 Permanently Stored (Models 1,2,3).

EMISSIONS BEING CLEANED UP – CO2 CAPTURE

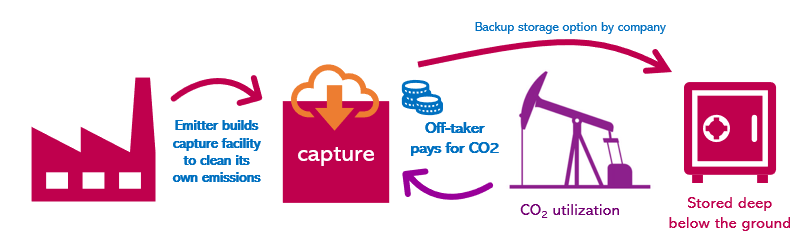

Model -A- Clean Up after Yourself

Model -B- The Janitor

Model -C- Sustained Supply

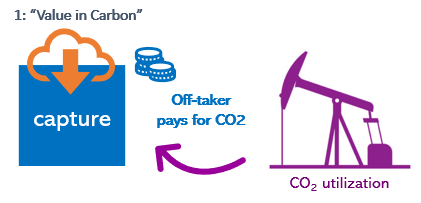

CO2 PERMANENTLY STORED

COMBINING MODELS

BUILDS BETTER BUSINESS CASES

The Alberta Carbon Trunk Line (ACTL) is another example combining models to build a better business case. It brings together multiple partners using proximity and the notion of a hub, the ACTL will aim to maximize the opportunities for capture, utilization in the oil fields, and permanent sequestration. ACTL will consist of a 240 km pipeline that can transport up to 14.6Mt of CO2 per year at full capacity. The CO2 in intended to be transported from capture plants at different industrial facilities and then either injected into depleted oil reservoirs for permanent storage or sequestered directly into a permanent deep geological storage site.

Coupling Models & Policy

Climate change is a formidable challenge that requires a formidable, collaborative approach along all avenues for emission reductions. CCS needs to be an active part of the toolkit now and into the future. To reach our collective commitment in the Paris Agreement, the value of CCS goes up, not down.

Business models coupled with market shifts can actively ensure a pickup in CCS deployment – and definitive and clear policies, through a creation of a variety of CCS incentives or subsidies will help drive market shifts.

A convergence of industries, government along with policy mechanisms, to support strong investment in CCS is imperative. Ultimately, and ideally, the world can achieve more large-scale CCS facilities, which means more emission reductions, and a cleaner industrial future.

—-

View the article Making A Business Case For Large-Scale CCS (PDF) as featured in the September/October 2019 Issue of Carbon Capture Journal (PDF – Full Issue)