by Zewei Yu, Senior Advisor, Asia Relations

International CCS Knowledge Centre

view PDF version of this article

China’s President Xi recently announced, at the UN General Assembly, that China aims “to have carbon dioxide (CO2) emissions peak before 2030 and achieve carbon neutrality before 2060″.1

CCUS a part of China’s Decarbonization

With China’s commitment, the goals of the Paris Agreement, which would otherwise appear too remote to reach, become closer to being achievable. With the largest production capacity in major heavy industry sectors to meet the international and domestic market demand as the world’s largest energy consumer and producer, China released the equivalent of about 10 billion tonnes of CO2 into the atmosphere in 2018, according to the Global Carbon Project that tracks emissions worldwide.2

China’s pledge of carbon peaking and neutrality is ambitious and inspiring. In order to meet such a large commitment, all low-carbon solutions will be required. China has an opportunity to deploy carbon capture, utilization and storage (CCUS) as a priority for its energy sustainability, while it boosts other strategic sectors, such as hydrogen, transportation electrification, smart grid corridors, and carbon sinks of forestation. Across all low-carbon energy solutions, CCUS will play a critical and evolving role for China’s energy transition as a competitive companion to renewable energy.

Large-scale CCUS is currently the only solution available to significantly, and directly, reduce or avoid some of the most hard-to-abate emissions from existing key heavy industrial facilities in the next decade and into the foreseeable future. As China continues to grow, a greater number of manufacturing processes will need to be decarbonized. Business models and experiences of full-chain, large-scale CCUS deployment and commercial operations from proven iterations can aid in decarbonizing the flue-gas emissions from the production processes of cement, iron & steel production, chemicals, refineries, and power generation. China may have to rely on an energy mix including decarbonized fossil fuel-based energy with low- to no-carbon emissions during its energy transition.

Progress in China on CCUS

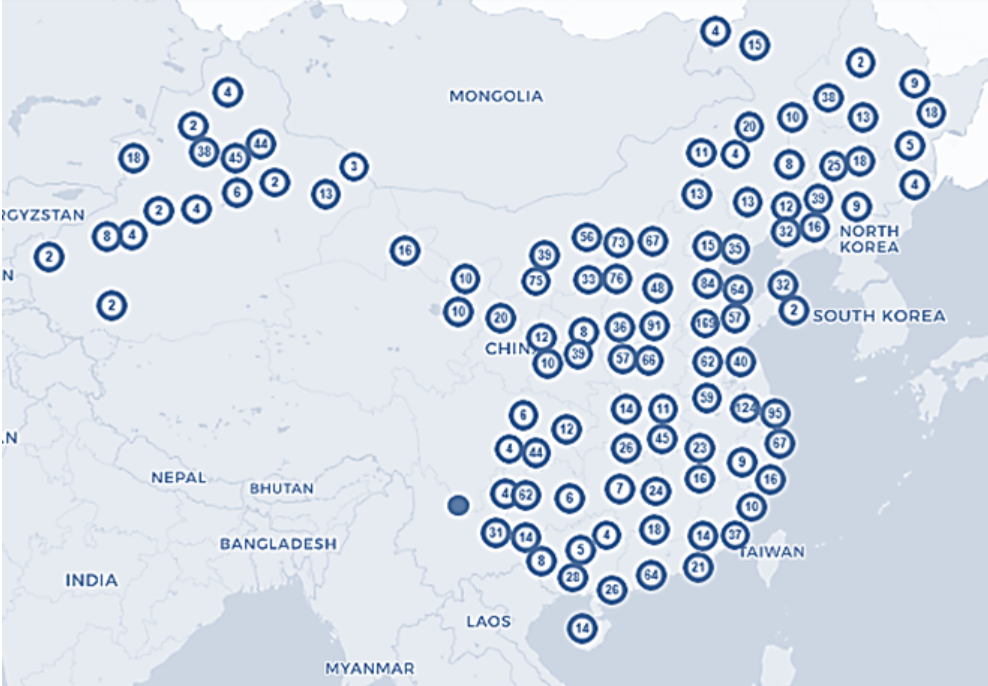

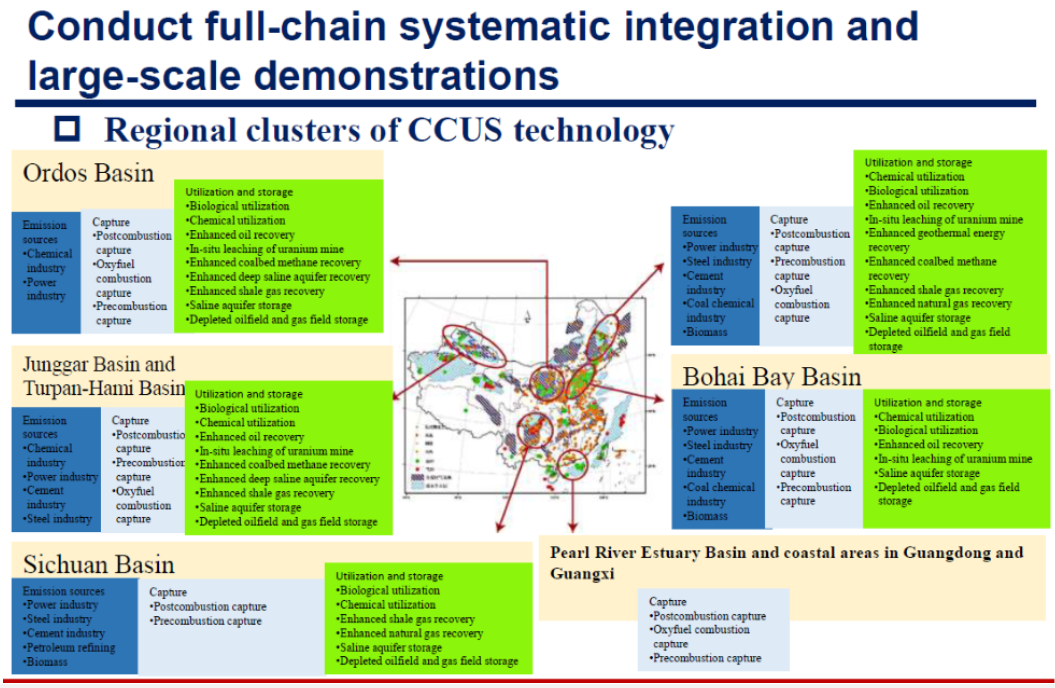

For over a decade, China has had the highest number of CCUS piloting projects in the world. Initial attention was given towards retrofitting existing fossil fuel-based?power and industrial?plants to understand how the capture technology system operated at small scale. These pilot-scale applications span a variety of available capture technologies such as post-/pre-combustion and oxyfuel combustion capture, as well as capture from hydrogen production with coal chemical processes to EOR and saline formation storage.3