as published in the Sep/Oct 2021 issue of Carbon Capture Journal

If you are looking for a country with a critical mass in creators in large-scale carbon capture, utilization, and storage (CCUS/CCS) technologies – look to Canada. The country can boast decades of experience right through and along the full chain, including innovative advancements and commercial operation in carbon dioxide (CO2) capture, pipelining, use, and permanent, safe geological storage and more recently, innovations direct air removals. With a renewed momentum and drive for emissions reductions nationally and globally, much of this activity in centred across the vast province of Alberta – which is positioning itself as a world leader in CCS with the potential to see that realized in the very near future.

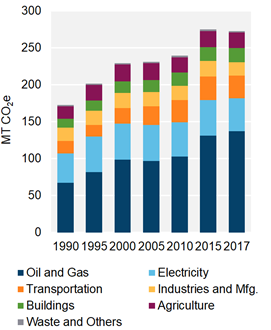

Alberta relies on revenues from large industries – they are the backbone of the province’s economy. On the flip side, with 70 percent of emissions coming from these sectors, Alberta’s economic identity is tied to the province’s large emissions profilei. In contrast, the industrial sector in Canada contributes approximately 36 percent of the country’s total emissions. So, Alberta is primed to take action and is doing so with both a sense of urgency as it leans on Canada’s formidable expertise in CCS.

GHG emissions in Alberta by sector, 1990 – 2017

Alberta’s $30B Ask for their next 30Mt

In the spring, Alberta underscored their commitment to Canada’s ambitious 2030 and 2050 targets by publicly announcing they would substantially reduce the province’s major sources of industrial emissions with large-scale CCS. The goal is to double their already ongoing emissions reduction contribution of 30 million tonnes (Mt) to 60Mt or more with a pitch for a CDN$30 billion investment from the Canadian federal government. This money will likely be made available through funding program such as the Strategic Investment Fund, Canadian Investment Bank, and/or Investment Tax Credit and accessible to all provincesii.

The two levels of government (federal and provincial) have now established a bilateral working group to jointly “leverage Alberta’s early CCUS leadership to advance climate goals, attract project investments and support economic recovery and future prosperity”iii. Jointly the group will determine avenues to leverage value from existing mechanisms and construct financial structures that integrate or stack other investment options. This would support CCS project advancement in Alberta by maximizing funds from both levels of government, streamlining processes, addressing duplications, and reducing administrative burdens.

The positive ripple effect of CCS investment for communities and economies is substantial. The construction and development of only three CCS projects in Canada would directly generate nearly CDN$1.1B in GDP; roughly CDN$2.7B in when taking into consideration indirect and induced effects over the construction horizon; and support over 6,100 jobs across Canadaiv. With at least 30Mt on the table, that number would multiply, potentially by a factor of 10. So, with the CDN$30B ask by Alberta injected into large-scale CCS, the return on investment would not only prevents megatonnes of CO2 emissions into the atmosphere, but it would also have significant ripple effect for the Alberta and Canadian economies.

CCS on a Roll in Alberta

While Alberta has a long history in CCS technology stemming from oil and gas, it also has a unique broad sector approach to emissions reductions in working with large emitters (refineries, fertilizer plants, cement plants, etc). There are many available emission reduction pathways in Alberta, with CCS being just one of those avenues – but one with immense potential for the future.

Two existing projects that stand out among Alberta’s largest emission reduction projects are Quest and the Alberta Carbon Trunkline (ACTL). Operating since 2015, Quest captures and sequesters 1Mt CO2 annually. Operating since 2020, ACTL has a 14.6Mt CO2 pipeline capacity – designed as a trunkline connecting and transporting infrastructure for captured CO2 to move from point sources to sinks in a hub.

Sinks are the deep geological formations that are well suited for safe, permanent sequestration of CO2. Alberta is blessed with an abundance of them. In fact, between Alberta and Saskatchewan, there is almost 400Gt of storage potentialv. With a motivated industrial sector willing to capitalize on bringing together their needs and cluster infrastructure into hub opportunities, Alberta is on the cusp of a new wave of full chain CCS.

Recently five Alberta companies which account for 90% of Canada’s oil sands production committed to a joint strategy to reach net zero gas emissions by 2050vi. With a 3-phased approach to reducing emissions of 68Mt per year by 2050, the first phase includes a major CCUS trunkline connecting oil sands facilities to a carbon sequestration hub, with phased expansion capability to gather captured CO2 from more than 20 oil sands facilities and available to other industriesvii.

Some of the additional encouraging signals of CCS projects in Alberta include announcements, such as: the Lehigh CCS Feasibility Study, in partnership with the International CCS Knowledge Centre and funding through Emissions Reduction Alberta, completing an examination of carbon capture on the process emissions from the Lehigh cement plant (to be published October 2021)viii; Shell Canada’s Polaris project, looking to collect CO2 emissions from its refinery and chemical facilitiesix; Pembina and TC Energy partnership to construct a pipeline, referred to as the Alberta Carbon Grid with a capacity to transport 20Mt of CO2 per year;x and, Air Products goal to construct a net-zero hydrogen energy complexxi.

Policy and Regulatory Framework Promotes Certainty

The depth of experience in the application of CCS in Alberta expands beyond the companies that build and operate facilities to include the tried-and-true practices and guidelines that are necessary for safe and fair operations. Alberta has put in place policy and regulatory frameworks that ensure public interest and assurance as well as environmental sustainability. This includes well established regulations and practices for measuring, monitoring and verification, rules for long-term liability, and the establishment of a carbon capture fund with required knowledge sharing criteria.

These frameworks also improve the confidence and certainty of investors. An example is the Technology Innovation Emissions Reduction (TIER) regulation. The TIER implements Alberta’s industrial carbon pricing and emissions trading system and helps industrial facilities find innovative ways to reduce emissions and invest in technology to stay competitive and save money.

There is also a proposed Carbon Sequestration Tenure Management framework where the government of Alberta intends to give carbon sequestration rights through a competitive process to strategically store CO2 in various storage hubs – as opposed to one-off sequestration projects (this process will not limit or apply to the current process for enhanced oil recovery permitting)xii. The intent of this framework is to provide confidence to industry investors (and Albertans) that captured CO2 will have a place to be sequestered at an open access basis and at a fair service rate with the operator managing credits and monitoring criteria.

Alberta’s Offerings in the Global CCS Space

The momentum and clear direction of development for CCS in Alberta coupled with its substantial experience in operation, regulatory know-how, and hub opportunities make the province a good model for other regions. This is an inspiration within Canada, and Alberta’s lessons offer a springboard for further advancements in CCS, and therefore large emissions reductions, in the near-term at the global level.

—

Download this article among others focused on CCUS in Canada from the CCJ, here.

iEnvironment and Climate Change Canada. National Inventory Report

iiCBC (March 2021) Alberta asks federal government to commit $30B to advance carbon capture technologies

iiiGovernment of Canada. Canada and Alberta Launch Steering Committee to Advance CCUS – Canada.ca

ivInternational CCS Knowledge Centre (2020) Incentivizing Large-Scale CCS in Canada

vInternational CCS Knowledge Centre. (2021) Canada’s CO2 Landscape: A Guided Map for Sources & Sinks

viOil Sands Pathway to Net Zero

viiOil Sands Pathways to Net Zero – A Phased Approach to Achieve Net Zero Emissions

viiiInternational CCS Knowledge Centre (2019) Lehigh CCS Feasibility Study

ixShell unveils new carbon capture project amid wave of new CCS proposals in Alberta | CBC News

xTC Energy (June 2021) Pembina and TC Energy Partner to Create World-Scale Carbon Transportation and Sequestration Solution: The Alberta Carbon Grid

xiAir Products (2021) Air Products Announces Multi-Billion Dollar Net-Zero Hydrogen Energy Complex in Edmonton, Alberta, Canada

xiiCarbon capture, utilization and storage – Overview | Alberta.ca